Hi all,

Welcome back. If you haven’t already - let us know how frequently you’d like to receive this newsletter.

Here are our results so far:

How often would you like to receive this newsletter?

🟨🟨🟨⬜️⬜️⬜️ Daily (Current) (33%)

🟩🟩🟩🟩🟩🟩 Twice a week (Tuesdays and Thursdays) (67%)

Now here are our top news stories:

Meta's Big Bet: Superintelligent Glasses 👓

Meta's all-in on AI as Mark Zuckerberg is pushing Meta's chips into the center of the table with a two-pronged bet on the future: smart glasses and "superintelligence".

The company just unveiled its first smart glasses with a built-in screen.

Simultaneously, it's pouring billions into an AI talent and infrastructure arms race, a strategy that—so far—has Wall Street buzzing.

Why it matters: Zuckerberg's vision is for glasses to one day replace the smartphone.

The goal is to create a ubiquitous computing device that overlays the digital world onto the real one, powered by an AI smarter than humans.

"Glasses are the only form factor where you can let it see what you see, hear what you hear... and very soon, generate whatever [user interface] you need right in your vision, in real time."

The Hardware: 🚀 Meta's new "Meta Ray-Ban Display" glasses were flaunted on stage at its flagship conference.

The glasses can overlay text messages, video calls, and responses from Meta's AI assistant directly onto a lens.

They are controlled by a wristband that detects small hand movements, which Zuckerberg called "the world's first mainstream neural interface".

The new glasses will sell for $799.

The Goal: "Personal Superintelligence" 🧠 The new hardware is just a vehicle for Zuckerberg's larger ambition: building superintelligence, defined as "AI that surpasses human intelligence in every way".

"Superintelligence... is coming 'sooner rather than later.'"

The big picture: Meta has radically reorganized its efforts to compete with rivals like Google and OpenAI.

The company's AI team was restructured for the fourth time in six months, now called the "Meta Superintelligence Lab".

It's been on a high-profile hiring spree, offering sign-on bonuses as high as $100 million to poach top researchers from competitors. Shengjia Zhao, formerly of OpenAI, is the new chief scientist.

By the Numbers: Wall Street is Cheering 📈 Despite massive investments in AI, Meta's financials remain strong, handily beating Wall Street expectations in its Q2 report.

Earnings per share: $7.14 (vs. $5.88 expected).

Total Revenue: $47.52 billion (vs. $44.81 billion expected).

Q3 Forecast: A range of $47.5 billion to $50.5 billion, well above the $46.23 billion analysts estimated.

The bottom line: Today's AI is already boosting Meta's profits.

AI-driven recommendations led to a 5% increase in time spent on Facebook and a 6% increase on Instagram last quarter.

"AI is unlocking greater efficiency and gains across our ad systems."

Between the Lines: Risks Remain 🤔 The ambitious push isn't without its challenges and contradictions.

Investor Jitters: Meta's stock fell in August on reports the company was considering downsizing its AI division, showing how quickly the spending spigot can shut off.

Safety Concerns: Zuckerberg acknowledges that "Superintelligence will raise novel safety concerns," and the company will need to be "careful about what we choose to open source".

Supply Chain: The new glasses are made by Chinese manufacturer Goertek, a reliance that exists despite Zuckerberg's increasingly anti-Beijing rhetoric.

📺 Kimmel Canceled

Disney-owned ABC has pulled Jimmy Kimmel's late-night show "indefinitely" after he made comments suggesting the man accused of killing conservative activist Charlie Kirk was a "Maga" supporter.

"Congratulations to ABC for finally having the courage to do what had to be done. Kimmel has ZERO talent."

The move came after intense criticism and pressure from federal regulators and the White House.

Why it matters: ⚠️ The suspension of a major media figure shows the Trump administration's signaled crackdown on speech is no longer just talk.

It marks a significant escalation in the use of regulatory pressure against media companies perceived as critical of the president.

Driving the News: The action against Kimmel followed direct and public pressure and is part of a broader push by the administration and its allies:

Federal Pressure: FCC Chair Brendan Carr called Kimmel's comments "the sickest conduct possible" and openly warned that his agency could revoke ABC affiliate licenses unless Disney acted. "We can do this the easy way or the hard way," Carr stated.

White House Response: President Trump celebrated the decision, posting, "Congratulations to ABC for finally having the courage to do what had to be done". He then urged NBC to cancel the shows of Jimmy Fallon and Seth Meyers.

⚖️ Broader Crackdown: The move comes as Attorney General Pam Bondi has vowed to "go after" people for "hate speech" and VP JD Vance has encouraged followers to "call their employer" to report those celebrating Kirk's murder.

The Irony: 🎤VP Vance himself criticized Europe's approach earlier this year, stating, "In Britain, and across Europe, free speech, I fear, is in retreat".

📉 At a moment when free speech needs thoughtful defenders, its most vocal self-proclaimed champions are using a tragedy to justify a crackdown that could limit the very freedoms they once claimed to hold sacred.

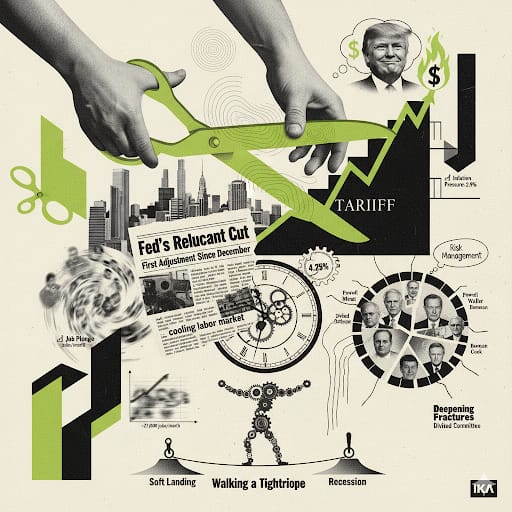

Fed's Reluctant Cut ✂️

The Federal Reserve finally blinked. The Fed cut interest rates Wednesday for the first time this year, a reluctant step to shield the economy from a rapidly cooling labor market.

But new projections show this is far from the aggressive cuts President Trump wants.

Why it matters: The world's most important central bank is walking a tightrope.

On one side: Alarmingly weak job numbers. Job growth has come to a near-halt over the summer, forcing the Fed to act.

On the other: Inflation that remains "somewhat elevated", fueled by tariffs.

Driving the News: The policy-setting Federal Open Market Committee lowered its benchmark rate by a quarter point to a new range of 4% to 4.25%.

This was the first adjustment since December.

Fed Chair Jerome Powell said the move was based on data suggesting "the labor market is really cooling off".

"I think you can think of this as a 'risk management' rate cut."

By the Numbers:

📉 Job plunge: Employers added only 27,000 jobs a month from May through August. That's a huge drop from the 123,000 jobs a month added in the first four months of the year.

📈 Inflation pressure: The Consumer Price Index was up 2.9% for the year ending in August.

🔮 More to come: The median Fed official now anticipates two more quarter-point cuts by the end of this year. The Intrigue: The consensus vote hides deepening fractures inside the Fed.

A new Trump appointee, Stephen Miran, dissented, arguing for a bolder half-point cut. Powell said there wasn't much support for such a large move.

Two other Trump appointees, Christopher Waller and Michelle Bowman, who dissented in July by demanding a cut, supported Powell's quarter-point move this time.

Gov. Lisa Cook, whom President Trump is actively trying to fire, voted for the cut after a court ruled she can keep her job while the case is litigated.

Meanwhile, Treasury Secretary Scott Bessent is already interviewing candidates to replace Powell when his term ends in May.

The Fed is trying to engineer the perfect "soft landing" — cooling the economy just enough to contain inflation without tipping it into a recession. It's a notoriously difficult maneuver that central banks have fumbled in the past, and Powell is attempting it amid intense political pressure and a deeply divided committee.

The bottom line: The Fed has pivoted to "risk management" mode. The question now is whether this cautious first step will be enough to stabilize a shaky labor market.