Today’s briefing:

How France Fell Apart

OpenAI's New Empire

Japan’s New Iron Lady

🇫🇷 Macron's France in freefall

France has been plunged into its worst political crisis in almost 70 years after Prime Minister Sébastien Lecornu resigned less than a month after his appointment.

Why it matters: The political paralysis in the Eurozone's second-biggest economy has sent markets tumbling and empowered the far-right, leaving President Emmanuel Macron with an ever-narrowing set of bad options.

The country is now described as "ungovernable".

"One cannot be prime minister when the conditions are not met."

Lecornu, a protégé of Macron, became the shortest-serving prime minister since the Fifth Republic was established in 1958.

How it fell apart: Lecornu failed to craft a budget that could satisfy the left, right, and center.

His decision to keep Macron loyalists and reappoint former finance minister Bruno Le Maire alienated the mainstream conservatives.

The Socialist party also threatened to vote down the government.

Market meltdown 📉: The chaos triggered a market sell-off.

The Cac 40 stock index fell, the euro slid against the dollar, and French borrowing costs jumped.

The interest rate gap over German bonds —a key market fear gauge—is near its highest level since the Eurozone debt crisis.

The turmoil is bolstering far-right leader Marine Le Pen, whose Rassemblement National (RN) party is already the largest in the assembly and is leading in the polls.

A new election would likely crush Macron's centrist parties while strengthening the RN.

"The interests of France require Emmanuel Macron to resign in order to preserve our institutions and to unblock a situation that has been unavoidable..."

The Bottom Line: ⏳ Macron, who is being blamed for the morass after his dissolution blunder last year, has ruled out resigning before his term ends in 2027.

His remaining options are grim:

Appoint another PM: This would be his fourth since last summer, further damaging his credibility.

Call new elections: A snap poll looks "inevitable if undesirable," as it would likely strengthen the far-right.

Muddle through: Macron could try to operate with a caretaker or "zombie government," but this would make it impossible to pass a budget and rein in France's massive public deficit.

Macron has given Lecornu 48 hours for last-ditch negotiations.

In the meantime, France's standing in Europe continues to weaken as investor concerns mount.

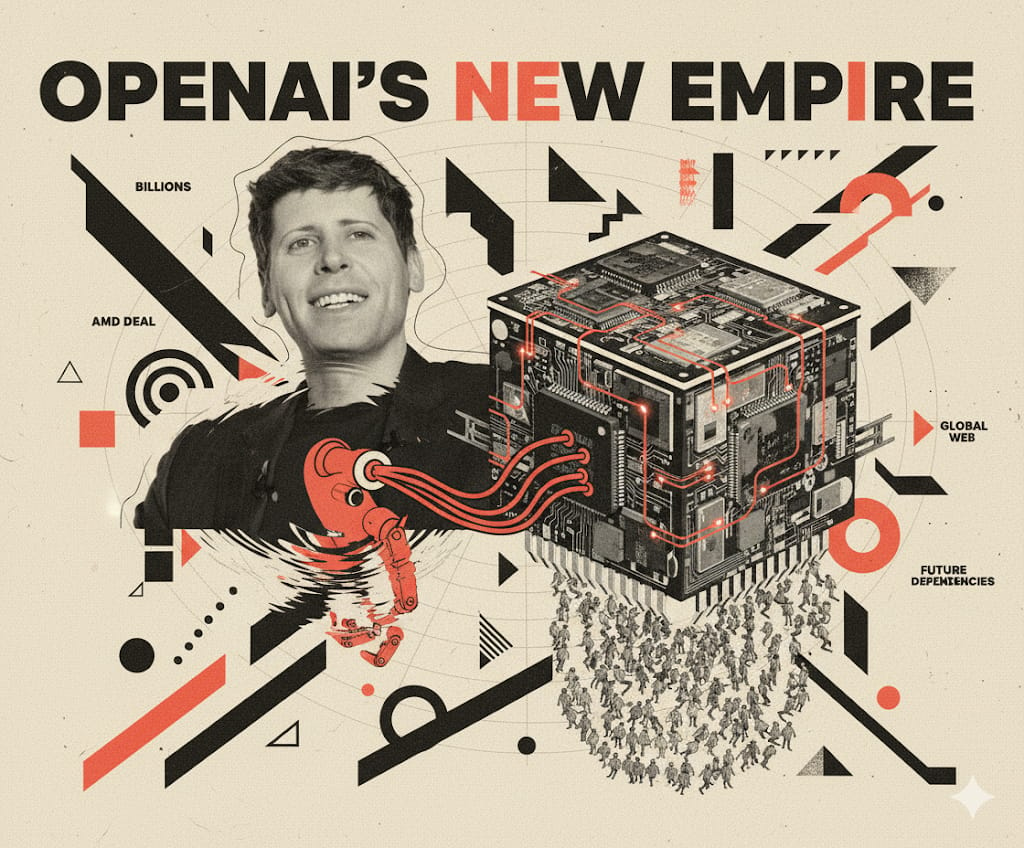

🕸️ OpenAI's New Empire

OpenAI is spending billions on AMD chips in a multiyear deal that could give the ChatGPT-maker up to a 10% stake in the semiconductor firm.

Why it matters: The AI revolution has an unquenchable hunger for computing power, and Sam Altman is locking down suppliers beyond market leader Nvidia.

The deal is another strand in a corporate empire of mutual dependencies, making OpenAI's success critical to some of the world's most important tech companies.

"This partnership is a major step in building the compute capacity needed to realise AI's full potential."

By the numbers:

🔋 6 gigawatts: The total power consumption of processors OpenAI agreed to purchase from AMD, roughly equal to Singapore's average demand.

🚀 $80 billion+: The surge in AMD's market capitalization minutes after the deal was announced.

🔌 23 gigawatts: Total new capacity OpenAI is committed to using across all its recent deals, which would cost over $1 trillion to develop.

The big picture: This is a new version of an old corporate habit. Sam Altman is creating an elaborate web of interlocking relationships, reminiscent of Japan's keiretsu model.

The AMD deal follows a similar, larger agreement with Nvidia, which plans to invest up to $100 billion in OpenAI.

OpenAI also partners with Google and has committed to buying $300 billion in computing power from Oracle.

Nvidia, in turn, owns a stake in data center firm CoreWeave, which also counts OpenAI as a shareholder.

"We're only in year two of a 'massive ten-year cycle' of rapid AI advancements and infrastructure build-out."

Between the lines: This is a massive win for AMD, long seen as a distant second in the AI race to Nvidia.

Although it has raised about $60 billion, OpenAI remains lossmaking and must find creative ways to pay for its expansion, including leaning on its partners' balance sheets and the debt market.

The bottom line: By intertwining his company's future with key players in the supply chain, he ensures they are all deeply invested in OpenAI's growth.

But if that growth stops, these win-win arrangements could quickly become lose-lose scenarios.

Like Moneyball for Stocks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Plus hiring data, web traffic, and employee outlook

While you analyze earnings reports, professionals track alternative data.

What if you had access to all of it?

Every week, AltIndex’s AI model factors millions of alt data points into its stock picks.

We’ve teamed up with them to give our readers free access for a limited time.

The next big winner is already moving.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

🇯🇵 Japan's "Iron Lady" triggers "Takaichi Trade"

The ascent of hardline conservative Sanae Takaichi as the leader of Japan's ruling party has unleashed a "Takaichi trade" in global markets, with investors betting heavily on a return to massive government spending and a weaker yen.

Japanese stocks surged to record highs on Monday.

Why it matters: Takaichi, who is expected to become Japan’s first-ever female prime minister later this month, signals a sharp pivot back to the "Abenomics" era of her late mentor, Shinzo Abe.

This means more fiscal stimulus, pressure on the Bank of Japan to keep interest rates low, and a fiery, hawkish foreign policy.

Takaichi, 64, is an acolyte of the late nationalist prime minister Shinzo Abe and even models herself on Margaret Thatcher.

Her rise heralds a direct revival of his policies and confrontational diplomatic style.

Abe's 2013-2020 premiership was marked by frosty relations with South Korea. His visit to the controversial Yasukuni shrine—which memorializes Japan's war dead, including convicted war criminals—triggered mass anti-Japanese demonstrations across China.

Takaichi has also stated her intention to visit the shrine. Analysts warn her political longevity will hinge on moderating her hawkishness to avoid fraying relations with Beijing, which would hit Japanese businesses hard.

What's next: Takaichi faces an immediate trial by fire with two major diplomatic tests:

U.S. President Donald Trump's planned visit to Tokyo in late October.

The Asia-Pacific Economic Cooperation (APEC) forum in Seoul, where she will have a face-to-face meeting with Chinese leader Xi Jinping.

The bottom line: While markets are cheering the prospect of stimulus, Takaichi must navigate a domestic political minefield and delicate international relations where one misstep could spiral pretty quickly.