On The Deals Shaping Our Economy

Paramount has launched a hostile takeover bid for Warner Bros. Discovery (WBD), going directly to shareholders with an all-cash, $108 billion offer designed to torpedo a rival deal with Netflix.

Why it matters: This is the ultimate Hollywood power struggle, pitting legacy media royalty against Big Tech, financed by Middle Eastern sovereign wealth, and playing out under the watchful eye of President Trump.

💰 The Offer

Paramount is offering $30 per share in cash for the entirety of Warner Bros. Discovery.

The contrast: Netflix recently clinched a deal valued at roughly $83 billion ($27.75/share) to acquire only WBD’s studio and streaming assets (HBO, Harry Potter), leaving the declining cable networks to spin off separately.

The argument: Paramount CEO David Ellison claims the Netflix deal leaves shareholders holding the bag with "an uncertain future" for the leftover linear TV business.

"We believe the WBD Board of Directors is pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process."

🏛️ The Trump Factor

President Trump has already signaled he will be "involved" in reviewing the merger, casting immediate doubt on the Netflix agreement.

Antitrust concerns: While Trump praised Netflix co-CEO Ted Sarandos personally, he flagged the streaming giant's dominance.

"They have a very big market share and when they have Warner Brothers that share goes up a lot. It could be a problem."

The patriotic pitch: Paramount executives are explicitly appealing to Trump’s "America First" agenda, promising to keep movies in theaters rather than sending them straight to streaming.

"Movies are one of America's greatest exports and we want to lean into that, not diminish it."

🤝 The Backers

Paramount’s war chest is filled by a complex web of high-profile financiers.

The Equity: Backstopped by the Ellison family and RedBird Capital.

The "Silent" Partners: A securities filing revealed backing from Jared Kushner’s Affinity Partners and sovereign wealth funds from Saudi Arabia, Abu Dhabi, and Qatar.

The workaround: To avoid national security (CFIUS) blocks, these foreign investors have agreed to forgo all governance rights and board seats.

The intrigue: Kushner, Trump’s son-in-law, is deploying capital from his private equity firm—which is 99% funded by non-U.S. sources—into a deal the President will review.

📉 The Cable Problem

Paramount argues its bid is superior because it values WBD's struggling cable assets (CNN, TNT, Discovery) higher than the market would as a standalone company.

Netflix's plan: Spin off the cable networks. Analysts value this "stub" equity at roughly $4/share.

Paramount's counter: They claim their bid solves the "stranded asset" problem by keeping the company whole.

Global fallout: The uncertainty is already hitting international markets, including South Africa for our readers.

MultiChoice (DStv) in Africa warns it may be forced to cut 12 WBD channels—including CNN International and Cartoon Network—by December 31 if a new deal isn't reached amidst the acquisition chaos.

⏭️ What to Watch

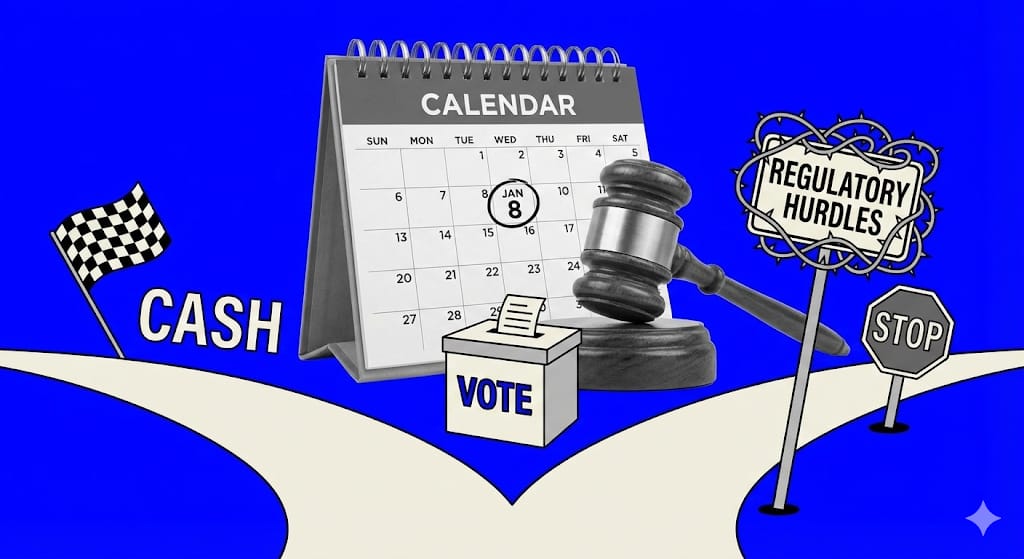

Shareholders have until January 8 to vote on Paramount’s tender offer, though the timeline could extend.

The Board: WBD’s board is currently sticking with the Netflix deal, citing higher closing certainty and a $2.8 billion breakup fee.

The deciding factor: It may come down to whether shareholders fear Netflix’s regulatory hurdles more than they love Paramount’s cash.

"If [Netflix is] allowed to buy WBD, there will be no more competition in Hollywood."

The global stage doesn't rest, and neither do I.

Your support doesn't just 'keep the lights on,' it funds the reporting into the geopolitics and economic deals that matter.

Back the reporting.